CONTRACTOR’S TOOLS AND EQUIPMENT

What is contractor’s tools and equipment insurance?

When do businesses need contractor’s tools and equipment insurance?

Contractor’s tools and equipment insurance is designed for construction and contracting companies that work at different job sites. It protects movable tools and equipment wherever they are stored and pays for repair or replacement if they are lost, damaged, or stolen. However, it does not cover general wear and tear.

This coverage is a form of inland marine insurance for small tools and equipment under $10,000. It can typically be added to your commercial property insurance policy.

This policy covers:

-Tool theft

-Equipment breakage

-Misplaced or lost items

-Vandalism

-Damage to leased or rented equipment

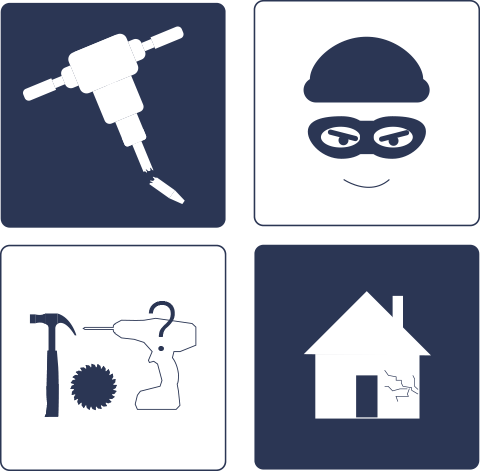

Contractor’s tools and equipment insurance protects against the unique risks of movable property

Add contractor’s equipment coverage to your BOP

What does contractor’s tools and equipment insurance cover?

Stolen tools

Broken or damaged equipment

Vandalism

Leased or rented items